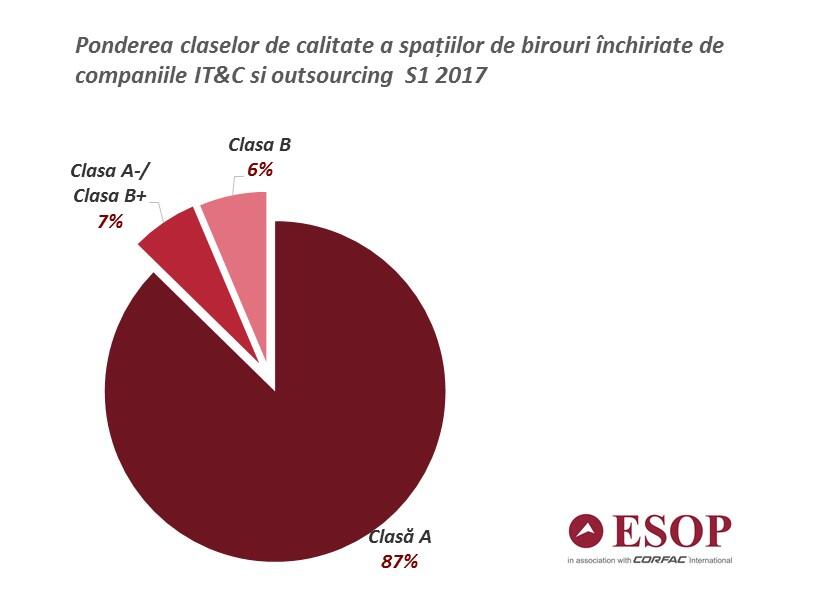

The percentage is much higher, of 87%, among IT & C companies, compared to 58% of the rented office space in all areas of activity.

IT & C is the most important part of total office transactions, dominating current demand, with 51% of the total volume of transactions, which is expected to remain the same within the next five years as the IT & C industry continues to grow.

"Over the past three years, IT & C has rented mostly Class A offices, an aspect that confirms both maturing and consolidating the field, as well as a constant, but increasing need of comfort and competitiveness in attracting specialized workforce. IT & C companies are more concerned about the office, working environment being as attractive to employees", says Alexandru Petrescu, Managing Partner at ESOP Consulting l CORFAC International.

What Are A Class Offices

Class A offices are buildings located in central locations with very good access to public transport, with state-of-the-art technical equipment (and, more recently, certified as green buildings).

Most of the times, buildings with a leasable area of more than 10,000 square meters offer tenants a range of complementary functions and services such as the presence of fitness halls, restaurants and cafes, meeting and conferencing facilities and of common relaxation areas.

Which A class buildings have been rented and by whom

The Class A office buildings chosen by tenants in the first semester include Green Court, Aviatorilor 8A, Metroffice, Times Square, Globalworth Tower, The Bridge, Bookcase, Sky Tower and Europe House in Bucharest, The Office in Cluj Napoca, Openville And Bega Business Park in Timisoara.

IT & C companies renting or pre-renting Class A office buildings are IBM, Netcentric, Bitdefender, Nespresso, Samsung, Microsoft, Wipro, Oracle, Fitbit, DCS +, Telenav, Atos and Huawei.

IT & C companies rented more than average office space

Another distinctive feature of office demand from IT & C companies is that leased areas are much larger.

Three quarters of IT & C companies rented surfaces ranging from 1,000 sq m to 10,000 sq m, while 21 percent of over 10,000 sq m and only 6 percent of the total office space leased by IT & C companies have areas of less than 1,000 sq m.

Compared to the entire rental market, the share of the areas ranging from 1,000 sq m to 10,000 sq m is 60 percent, office space of over 10,000 sq m is 25 percent and the space of up to 1,000 sq m is 15 percent of the total.

The average area rented by IT & C companies in the first half of 2017 is 2,428 square meters, while the average of the entire market is 1,712 square meters.

"We are confident in the evolution of the IT & C segment in Romania and not only in its quantitative but also qualitative expansion. If 10 years ago the projects that were attributed to Romanian subsidiaries were projects of low complexity and low added value (usually support / call-center services), in recent years we have noticed a constant increase in the type of developed solutions.

A turn is being registered from relatively simple activities to more complex activities, to research & development centres, activities that generate greater added value in Romania and, implicitly, greater care for employees, including the requirements for office choices", adds Alexandru Petrescu. (source: ESOP)