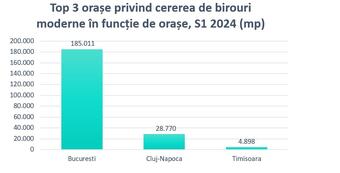

In the first half of the year, companies in Bucharest leased 84% of the total volume of modern office space traded in the country. Cluj-Napoca is in second place among the top cities, with a share of 13% of the total rented space and a total area of 28,770 sqm, followed by Timisoara with 2%, and the remaining percentage is divided between Brașov, Sibiu and Galați.

"In Bucharest, the new demand for office space has exceeded the volume of lease renewals. A surprise was the high demand from some educational institutions, which rented or pre-leased a total of 25.9% of the space in order to convert it into classrooms with educational facilities. On the other hand, in the other cities - Cluj-Napoca, Timisoara and Brasov - the volume of contract renewals was higher than the new demand, following the wave of deliveries four -five years ago. However, there were also large tenants who rented new spaces, such as Banca Transilvania, Deloitte, Medical Clinique, Medlife and Ixxus", says Nicolae Ciobanu, Managing Partner - Head of Advisory at Fortim Trusted Advisors, member of the BNP Paribas Real Estate Alliance.", said Nicolae Ciobanu, Managing Partner - Head of Advisory at Fortim Trusted Advisors, member on the BNP Paribas Real Estate Alliance.

Leasing in Bucharest

The majority of the companies that opted for offices in Bucharest came from the IT & C sector (29%), followed at a short distance by the private education sector. The largest contract signed in the first months of 2024 was the lease of 10,000 sqm of space by Genesis College, in Petrom City, for its conversion into classrooms and educational facilities.

The northern areas, Floreasca - Barbu Văcărescu and the centre were the most requested locations.

The most attractive city outside the capital, Cluj-Napoca

Since the beginning of the year, a total of 28,770 sqm of office space has been rented in Cluj-Napoca. This is five times more than in the same period last year (when only 5,422 sqm were rented). Lease renewals are mainly responsible for the jump in 2024.

The city of Timisoara is far behind in terms of volume, with a total of 4,898 sqm leased in 2024. This is a decrease compared to the same period last year (7650 sqm).

"The office vacancy rate has fallen to 13.4% in Bucharest (from 14.9% at the beginning of the year) and to 11% in Cluj-Napoca (from 13.8%). This is due to the lack of new supply. In the pipeline period, developers will be cautious. They will start large projects only when pre-letting contracts have been signed. There are several large, well-located mixed-use projects under development, with retail, restaurants, services of all kinds, including medical and educational, alongside office space," says Costin Nistor, Managing Director of Fortim Trusted Advisors, member on BNP Paribas Real Estate Alliance.